Percentage of paycheck to taxes

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. If an employees hourly rate is 12 and they worked 38 hours in the pay period the employees gross pay for that paycheck is 45600 12 x 38.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

E-1 through E-4.

. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. All other individuals who do not fit these criteria should leave the nonresident employee tax percentage field blank do not enter 0. BAH is halfway between the calculated amounts for a 2 bedroom apartment and a 2 bedroom townhouse.

Next you will need to calculate overtime for hourly workers and some salaried workers. The percentage can vary based on a variety of factors and it gets even more complicated now that the income tax brackets have changed. These are contributions that you make before any taxes are withheld from your paycheck.

For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month. You can either enter the year-to-date YTD figures from your payslip or for a single pay period. That 250 would be pulled for your insurance payment and youd pay taxes.

The following check stub calculator will calculate the percentage of taxes withheld from your paycheck and then use those percentages to estimate your after-tax pay on a different gross wage amount. While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. But its important to make sure the right amount is being taken out to avoid a big tax bill in April.

Such as to calculate exact taxes payroll or other financial data. Depending on your location you might pay local income tax and state unemployment tax as well. The impact on your paycheck might be less than you think.

If your situation is that no federal taxes were taken out of your paycheck youll still have to pay this penalty although it is a relatively small one based on a percentage of the taxes you. Then include any overtime pay. While increasing your retirement account savings does lower your take home pay it also lowers your Federal income tax withholding.

Family or financial obligations might require that you bring home a bigger paycheck each. For example if the calculated amount for a two bedroom apartment is 800 and. However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed.

With each paycheck youll see money taken out for taxes. Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your paychecks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Overview of Oregon Taxes Oregon levies a progressive state income tax system with one of the highest top rates in the US at 990. Estimate Taxes on Paycheck from Pay Stub.

Federal Income Tax Fit Payroll Tax Calculation Youtube

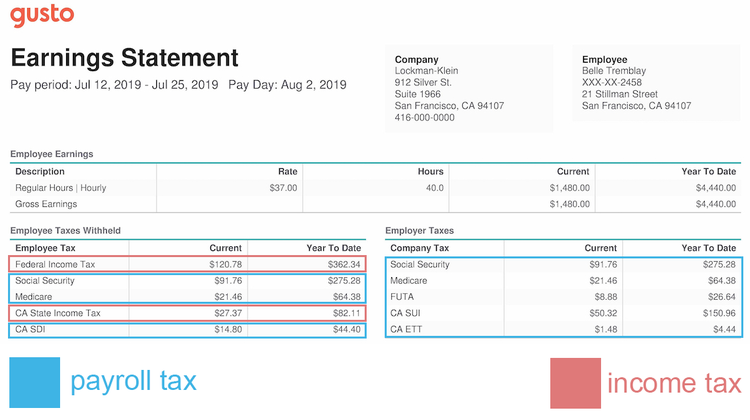

Payroll Tax Vs Income Tax What S The Difference

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Irs New Tax Withholding Tables

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Online For Per Pay Period Create W 4

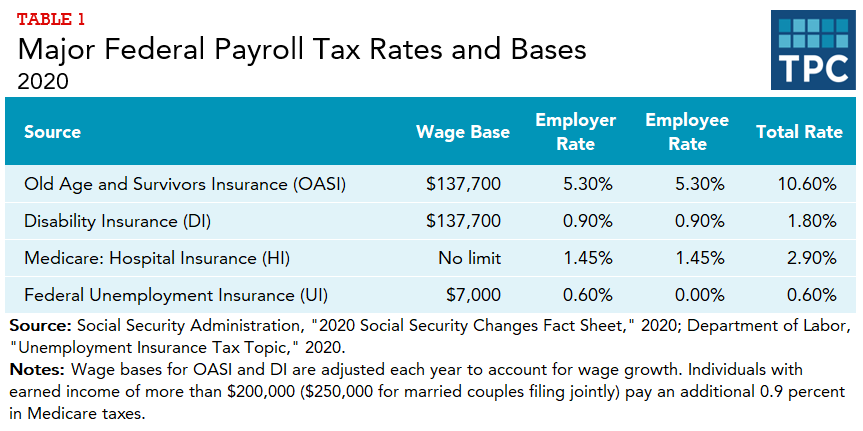

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Different Types Of Payroll Deductions Gusto

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How To Calculate 2019 Federal Income Withhold Manually

Understanding Your Paycheck

2022 Federal State Payroll Tax Rates For Employers

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center